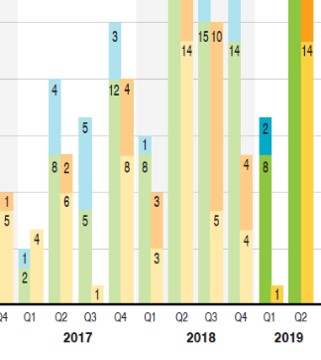

Fenwick & West: Key Metrics for Technology and Life Sciences Initial Public Offerings H1 2019

Fenwick & West just released its survey on key metrics for initial public offerings in the technology and life sciences industries. Among its many interesting findings are: “The 59 life sciences and technology offerings completed in the first half of 2019 compared with the 57 in the second half of 2018, continuing a trend of