Or a radically new approach to goodwill.

Introduction

Much is being said these days about the utility of accounting for goodwill. Two key concerns seem to dominate the discussion: conceptual vagueness of goodwill, the uncertainty of subsequent accounting, and related accounting costs. While certain aspects of accounting for goodwill warrant deeper review, it seems that most current proposals attempt to band-aid deeper issues with goodwill accounting.

Much is being said these days about the utility of accounting for goodwill. Two key concerns seem to dominate the discussion: conceptual vagueness of goodwill, the uncertainty of subsequent accounting, and related accounting costs. While certain aspects of accounting for goodwill warrant deeper review, it seems that most current proposals attempt to band-aid deeper issues with goodwill accounting.

The balance sheet is dying. Surely, it contains a lot of information and accounting is complex. But do we need all this information? Does an investment manager or a corporate board need to look at it? How much does a balance sheet tell us about a company in the context of the whole enterprise?

How Much Does Balance Sheet Tell Us About a Business?

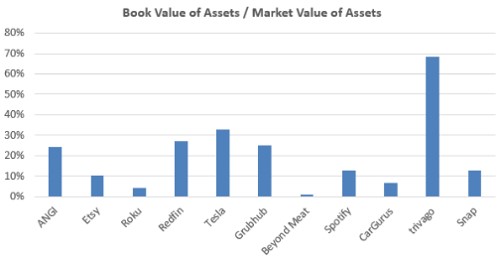

The truest measure of a company’s size (in the financial reporting world at least) is the market value of invested capital, i.e. market capitalization plus debt. In order to see how much balance sheet tells us about a business, we measured the ratio of (Book Value + Debt) / (Market Capitalization + Debt). The lower the ratio, the less the balance sheet tells us about the company. In certain industries the results are abysmal.

In the sample below, balance sheets struggle to explain 25% of the overall company values. Note, we did not even remove goodwill or intangibles. Even car manufacturer Tesla gets to 33% only. For high flying Roku and Beyond Meat, balance sheets are a negligible part of the story. So if the main concern in goodwill account is cost, we suggest eliminating the balance sheet altogether.

The difference between the book value and market capitalization is commonly attributed to intellectual property such as technology, brands, and customer loyalties. It will also include going concern value, speculative bets on new business lines, business processes and even corporate culture. Some of these assets are captured in purchase accounting, but most never make it on the balance sheet. Instead, the true aggregate value of all intellectual property is determined on financial markets.

The difference between the book value and market capitalization is commonly attributed to intellectual property such as technology, brands, and customer loyalties. It will also include going concern value, speculative bets on new business lines, business processes and even corporate culture. Some of these assets are captured in purchase accounting, but most never make it on the balance sheet. Instead, the true aggregate value of all intellectual property is determined on financial markets.

Our Proposal

Goodwill is incorporated into purchase accounting as a residual of the market price of a target after identifiable assets and liabilities have been accounted for. We propose recording goodwill for all companies, on the reporting unit basis. We will refer to it as Enterprise Goodwill (“EG”). The amount of Enterprise Goodwill will be calculated as the difference between the market value of the company and the book value of identifiable assets and liabilities at the end of each reporting period. The change in Enterprise Goodwill during the reporting period will be flushed through the equity account without affecting an income statement.

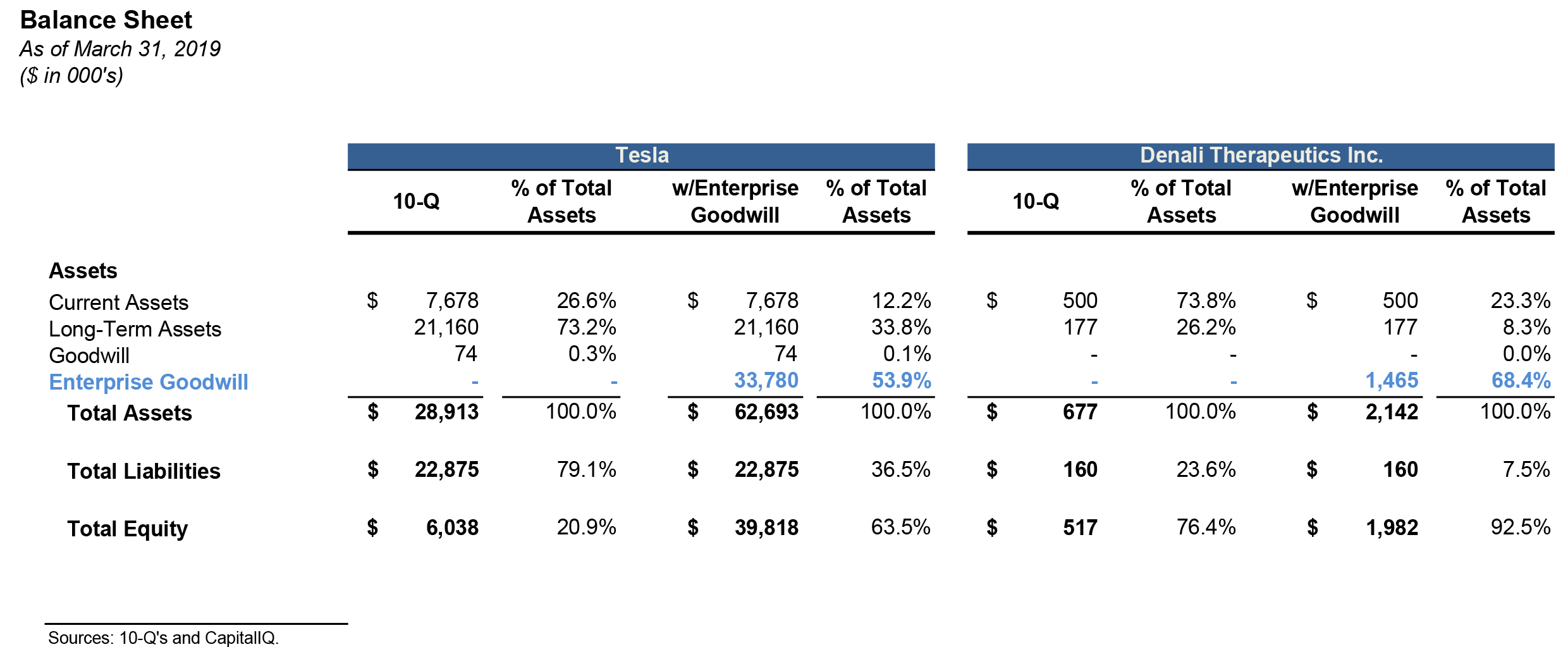

The presentation of Enterprise Goodwill would look something like below:

The Enterprise Goodwill will benefit financial reporting in the following ways:

[1] Enterprise Goodwill will create a link between assets recognized on the balance sheet and a company’s market value. As a reference point, the Enterprise Goodwill will help start a conversation about value drivers (or “invisible assets”) not explicitly listed on the financial statements.

[2] Enterprise Goodwill will help emphasize or de-emphasize the significance of various balance sheet items (e.g. indicated by their value as a percent of total assets including EG). It will help stakeholders prioritize when reviewing the balance sheet.

[3] It will provide a direct reference point within financial statements without having to separately consider the company’s stock price.

[4] Professionally calculated Enterprise Goodwill will free stakeholders from untangling the complex net of definitions of value, e.g. market capitalization vs. enterprise value vs. business enterprise value vs. market value of invested capital, etc. (my company is worth “$X” but what does it mean?).

[5] For private companies, goodwill recognition will force the management to think about the value of the company on regular intervals while providing a useful reference point for lenders and other stakeholders, or even facilitating liquidity in the secondary market transactions.

Coordination of New Enterprise Goodwill and Purchase Accounting

We don’t believe Enterprise Goodwill should affect the current approach to purchase accounting. Specifically, purchase accounting goodwill would be recognized and accounted for separately from Enterprise Goodwill. Having both purchase accounting goodwill and Enterprise Goodwill side by side will provide an instant view as to whether a company grows through acquisitions or organically.

Cost of Implementation

Before raising the question of “how much?” we have to understand whether we need Enterprise Goodwill and how much we need it. However, we don’t expect the cost to be substantial.

Calculating Enterprise Goodwill will be very simple for public companies. Private companies will require a separate valuation analysis, but there are many ways to lessen the burden. For example, for stock option issuing companies, valuation is already a periodic requirement. Others may choose to do Step Zero (i.e. qualitative analysis) and formal valuation every few years.