This article covers several key factors to consider when building a financial forecast or projected financial information (PFI). This guidance is designed for financial forecasts used in purchase price allocations, i.e., valuation of intangible assets as part of purchase accounting under US GAAP ASC 805 and IFRS 3. Here are a few requirements:

This article covers several key factors to consider when building a financial forecast or projected financial information (PFI). This guidance is designed for financial forecasts used in purchase price allocations, i.e., valuation of intangible assets as part of purchase accounting under US GAAP ASC 805 and IFRS 3. Here are a few requirements:

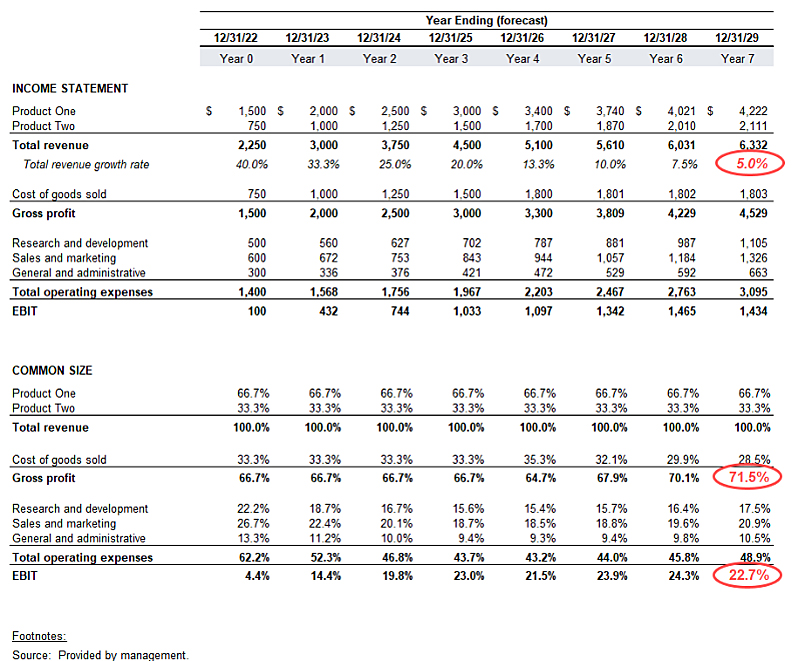

- PFI has to be long enough to allow the current business plan to play out before the target reaches steady financial performance, which in most cases means constant revenue growth rate and profitability, in perpetuity. Most forecasts go out at least 5 years.

- “Steady” revenue growth rate is the rate the target can maintain forever. Ideally, the forecast would go far enough to bring revenue growth rate into the 5-10% range for fast-growing businesses and 3-5% for more established operations.

- “Steady” profitability has to be consistent with that industry’s profit targets. Common red flags include (a) negative or nominal profitability in the last year of the forecast or (b) cost structure that does not include common corporate cost allocations, i.e., product contribution forecast vs. going concern forecast.

- The forecast has to break out revenues when different revenue streams support different intangible assets. It has to show the cost of goods sold and break out operating expenses such as sales and marketing, R&D, and G&A.

- Balance sheet and cash flow statement forecasts are necessary for some industries (e.g., capital-intensive industries) and highly desirable for others.

- PFI should reflect reasonable market participant expectations. In practice, that means excluding buyer-specific synergies (revenue or cost), which are synergies not available to other potential buyers. An example would be where two companies are located across the street from each other and can combine HQs in a single building with cheaper rent.

- PFI has to include the synergies that will accrue to the acquired target. The decision of who the synergies belong to, acquirer or a target, will always be subjective. The allocated synergies have to be consistent with the agreed-upon purchase price, i.e., something that was ultimately reflected in the purchase price.

- The forecast has to be reasonably optimistic. It has to be high enough to incentivize a market participant to pay the purchase price and win the deal. It should not be unrealistic either.

Sources Of The Financial Forecast

- PFI of at least 5 years is a requirement. The client has to provide the forecast – there is no work around it!

- A valuation specialist (a) can’t prepare the forecast for the client, (b) should be able to provide general guidelines outlined below, and (c) can test the forecast in the context of the guideline public company financials and internal rate of return calculations, all part of the standard PPA project.

- Most commonly, the PFI is prepared by the buyer, ideally, during the deal due diligence process. Otherwise, the management prepares the forecast for the valuation specialist.

- PFI prepared by a seller is commonly too optimistic. In fact, it does not reflect anyone’s view of the business, not even sellers’.

Preparing PFI can be an interactive process where the valuation specialist would solicit revisions when the PFI is not consistent with the purchase price as observed with too high or too low ROI. It is among the first documents needed for the PPA analysis, thus we recommend focusing on it before any other part of the project.