Fenwick & West just released its survey on key metrics for initial public offerings in the technology and life sciences industries. Among its many interesting findings are:

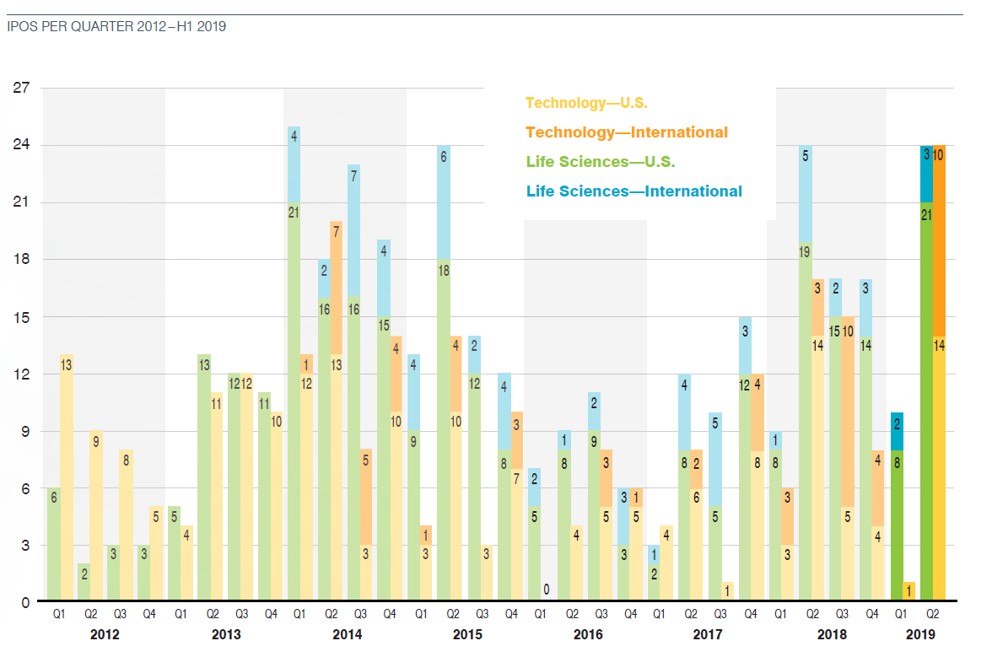

“The 59 life sciences and technology offerings completed in the first half of 2019 compared with the 57 in the second half of 2018, continuing a trend of stability. Still recovering from the effects of the federal government shutdown and stock market volatility that slowed capital markets activity in the last few months of 2018, the first quarter of 2019 saw one tech offering (Lyft) and 10 life sciences offerings. The pace picked up significantly in the second quarter, when 24 tech and 24 life sciences companies debuted. In all, 25 tech companies and 34 life sciences companies went public in H1 2019, on par with the 23 tech offerings and 34 life sciences offerings in H2 2018.

About valuations, the survey found:

“If tech IPOs in the second half of 2018 produced offering proceeds that were marked by an unusually large spread in valuations, H1 2019 did even more so. So far this year, about 12% of tech deals priced between $25 million and $75 million, another 16% between $100 million and $150 million, and another 28% priced between $175 million and $225 million. Life sciences offerings again showed more of a sweet spot in amounts raised: The majority of IPOs in the first half of the year (76.5%) raised between $50 million and $150 million.

“Only five tech and life sciences offerings in the first half of 2019 had proceeds of more than $1 billion. The largest was a technology offering for Uber that raised $8.1 billion. The largest life sciences offering, Avantor, raised $2.9 billion.

And about pricing:

“The clear majority of offerings in the first half of 2019 priced within or above-range —88% of tech offerings and 82.3% of life sciences offerings—underscoring a relatively strong and stable market environment. Just three technology offerings and six life sciences offerings priced below the red herring range. The results indicate that IPOs so far this year were well priced with healthy but modest first-day gains. Consistent with prior half-year periods, technology offerings enjoyed stronger first-day trading as 72% traded up at first day close compared to 64.7% of life sciences offerings.

The surveys outlook for 2H 2019 was:

“Our H1 2019 data suggests a healthy and stable market continuing, with deals well priced, trending up on average 72% on first-day close for tech and 65% for life sciences. While to date only two companies have done direct listings, more companies are considering this route to becoming public. We anticipate continued strength going into the second half of 2019, notwithstanding the potential for uncertainty surrounding the upcoming U.S. presidential elections and rhetoric around healthcare programs and policies, which may very well affect IPOs planned later this year. It is also unclear how long the bull market for tech and life sciences company IPOs will continue.

You can find the full survey HERE.