While stock options continue to lure enthusiastic professionals to start-up industries, the minimal liquidity of private company shares is weighing on the value of such compensation awards. Ever increasing pressure to transact in private securities gave rise to secondary markets where founders, executives, investors, and often employees get an opportunity to cash-out.

While stock options continue to lure enthusiastic professionals to start-up industries, the minimal liquidity of private company shares is weighing on the value of such compensation awards. Ever increasing pressure to transact in private securities gave rise to secondary markets where founders, executives, investors, and often employees get an opportunity to cash-out.

It takes a long time to see the fruits of your labor when the remuneration is tied in private company securities such as common stock options or shares themselves. For a lucky few companies, an average time to an IPO is reaching 13 years. A successful start-up can be sold sooner, but most valuable stock options are still those granted early-on and thus locked-up for a long time.

Secondary markets may facilitate the path to liquidity, but, in the absence of a price setting event, sellers and buyers have to determine their own transaction price. We will outline the following five approaches:

1. Benchmarking against most recent financing round,

2. Simplistic valuation,

3. Formal valuation study,

4. Adapting 409A valuation, and

5. A combination approach.

Benchmarking against most recent financing round is very common. Common shares are often priced at 10% to 50% discount to the most recent round. The discount is guesstimated base on company’s performance, its proximity to a strategic exit, and motivations behind the transaction.

| Higher Discount Perceived longer time to exit Not an IPO candidate Potential M&A target Concentration of voting power Lagging financial performance |

Lower Discount Approaching IPO Good financial performance Profitable or does not require financing Institutional ownership and board Simple capitalization table |

The benchmarking becomes more complex when a company has not raised funds recently or when recent funding, e.g. convertible debt, does not provide a clear indication of business enterprise value. There are a few options.

Simplistic valuation can be done literally on the back of the napkin (that is if you don’t already own a smartphone). Equity value can be estimated by multiplying revenue by appropriate multiple (check comparable companies on finance.yahoo.com) and subtracting debt. Share price can be estimated by dividing equity value by shares outstanding. This method is truly inadequate as it creates an appearance of analysis while key factors such as financial performance trajectory, triangulation of various market multiples, complexities of cap structure and marketability discounts are ignored. These flaws may result in valuations that are orders of magnitude from a reasonable range.

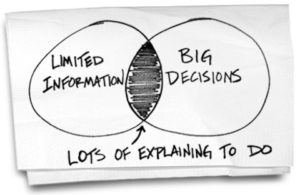

Commissioning your own formal valuation study is a good idea, but only if a seller or a buyer can negotiate full access to company information. It can also be expensive. If the transacting parties do have full access, then a clean and detailed 409A valuation report can be a more practical starting point.

409A valuations are prepared with the goal of estimating common stock fair market value, i.e. a theoretical effort to guess a proper secondary market price. 409A valuations take a holistic and fundamentally sound approach to:

♦ Business valuation,

♦ Preferred to common discount due to differential economic rights,

♦ Company valuation thresholds where different equity classes receive payouts,

♦ Comparable company valuation multiples, and

♦ Liquidity discount that scales based on the time to exit and business volatility.

Usefulness of 409A valuations can be limited due to perceived undervaluation of common shares in order to grant cheaper stock options, the complexity of financial modeling or inability to obtain a full valuation report from the company. Finally, 409A valuations don’t consider factors affecting every individual transaction and thus should never be relied upon without thorough review and proper adjustments.

In considering 409A valuations, it is important to understand how much prior secondary transactions influenced the fair market value estimate. Precedent transactions are given more weight when i) transacting parties are knowledgeable about the business, ii) transactions are sizable or frequent, iii) pricing is not affected by considerations unrelated to the shares fair market value. While precedent secondary transactions can improve 409A valuation estimate, certain parties may wish to exclude them as not applicable to a deal at hand.

A combination approach blends all available value indications while adjusting some to reflect circumstances surrounding each transaction. For example, a recent financing round can provide preferred share value as a starting point, while marketability discount can be obtained from a 409A report or recalculated based on transacting parties’ view on strategic exit options. In another example, an older 409A valuation can be adjusted to estimate present-day business valuation based on recent financial performance. Yet another approach would rely on a recent financing round in calculating discounts attributable to deferential economic rights of preferred and common stock; additional company sale or IPO scenarios can supplement the discount estimates. Finally, sufficient volume of secondary transactions may eliminate the need for the detailed valuation analysis.

In summary, secondary transactions will be increasingly important for privately held companies as a tool that enables reallocation of capital and talent. While legal, regulatory and logistical issues will remain, the secondary markets will benefit from consistent and transparent transaction pricing. Financing rounds and 409A valuations already provide good valuation benchmarks. Increasing trading volumes will amplify price discovery and reduce marketability discounts thus increasing the value of stock-based compensation for start-up stakeholders while decreasing the cost of private capital.

Contact Us To Schedule Your Free Consultation