Earn-out arrangements are common in corporate acquisitions. Earn-outs may help smooth out bid-ask spreads or incentivize sellers to continue contributing to a newly combined entity. In certain situations, acquired entities face significant milestones where acquirer’s risk becomes prohibitive without some kind of hedging mechanism.

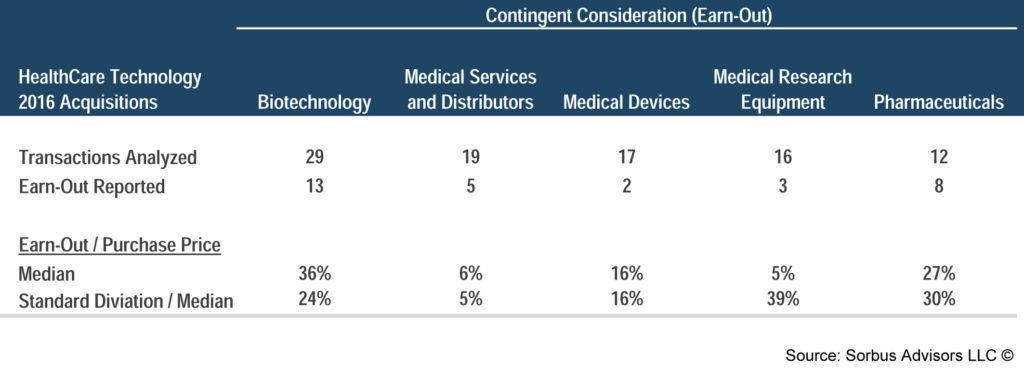

Prevalence of earn-outs varies by industry. Biopharmaceutical deals employ earn-outs to address significant risks associated with drug development milestones, binary events that can erase much of the enterprise value.

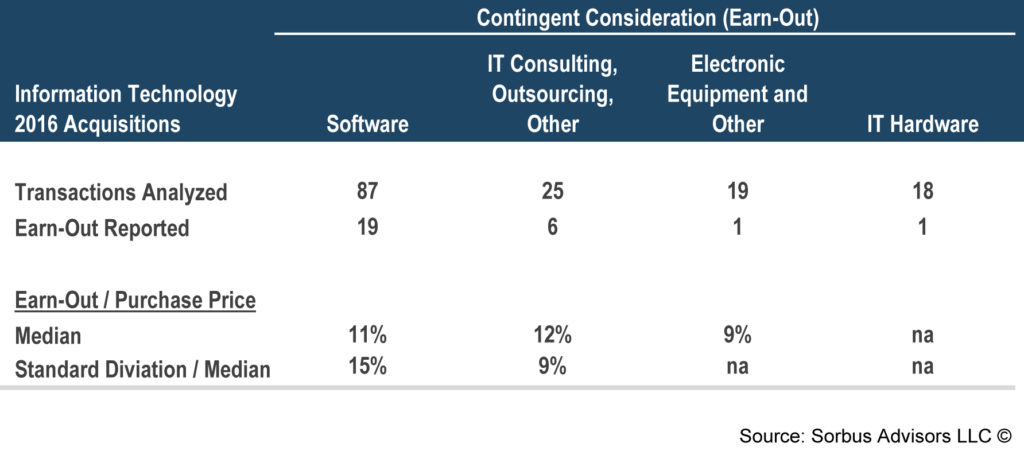

In the information technology industry, more earn-outs are found in its software and IT consulting segments. An earn-out may help where an underperforming target requires substantial reorganization with highly uncertain outcome.

Earn-Out Types

Payment arrangements that depend on various financial or key performance measure (“KPM”) achieving certain thresholds are notoriously hard to value. Yet, this is how most earn-outs are structured. Examples include earn-outs that:

♦ pay percentage or multiple of KPM(s) above or below certain threshold,

♦ pay fixed amount upon KPM(s) reaching a certain level,

♦ pay $X based on how KPM(s) will have performed leading up to a payment date.

If earn-outs are designed reduce transaction risks, thresholds make payouts more unpredictable. Buyer’s own financial statements (and deal economics) will suffer from unpredictable cash payments and income statement volatility.

Easier to value earn-outs often lead to more predictable outcomes. Examples of such arrangements include those that:

♦ pay certain percentage or multiple of KPM(s), unaffected by thresholds,

♦ pay $X upon achieving a milestone uncorrelated with financial markets (e.g. technological breakthrough).

Simplified earn-out arrangement make transaction pricing more transparent, future earn-out payments less volatile, and financial statements more intuitive.

The biggest mistake in formulating an earn-out is disregarding proper valuation methods as not reflecting “real-life” negotiations. The complexity of necessary valuation method reflects the complexity of the deal. Practitioners should not use earn-outs that require valuation methods they are not familiar with.

Common Valuation Methods

The most comprehensive paper, Valuations in Financial Reporting, Work Group 4 Exposure Draft: Valuation of Contingent Consideration, was published by Financial Reporting Working Group 4 of the Appraisal Foundation. Aimed at assisting earn-out valuations under financial reporting rules, the publication outlines fundamentally sound approaches applicable in any deal environment.

Scenario based method (“SBM”)

Scenario-based approach is effective at addressing linear payment schemes (no thresholds) or those with technical milestones. It is not recommended for valuing earn-outs dependent on KPM thresholds.

The method is built on identifying likely scenarios. Each scenario would be assigned probability, the value of relevant KPM, payment amount, timing, and applicable discount rate. While intuitive, SBM often falls short as it does not provide analytical insights such as scenario probabilities.

Option pricing methods (“OPM,” closed form, i.e. formula)

Most practitioners prefer valuing stock options using Black-Scholes formula, not SBM (even if many users won’t recognize the formula if they saw one). OPM is really an SBM that builds on an infinite (or approximately infinite) number of scenarios.

Earn-out can be viewed as an option to get paid when underlying KPM hits the threshold. Closed form OPM helps estimate probabilities of reaching threshold levels using an unbiased quantitative framework. It also side-steps the issue of deriving scenario discount rates which often have little to do with WACC. In short, closed-form OPM replaces subjective SBM with a hard formula that adds discipline and removes subjectivity from an earn-out valuation. Unlike SBM it adds new information to the analysis.

Option pricing methods (“OPM,” dynamic simulation)

More often, a single formula is not sufficient. Monte Carlo method is the only way to address path-dependencies (historical trajectory controls the amount of payout) or more complex interactions between varying inputs.

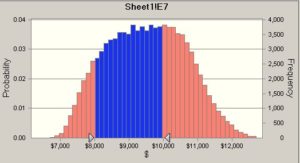

Monte Carlo is a process of running a single model numerous times, each time choosing inputs randomly but from the predetermined range. The model controls how inputs interact. The method produces a probabilistic valuation bar chart instead of a point estimate. In addition, it helps measure the impact of various payment conditions to guide negotiations.

Guiding Earn-Out Negotiations

Negotiating an earn-out is often a rush by each side to include, exclude or adjust numerous conditions in its favor. While individual impact of each condition is obvious directionally, net result of changing multiple conditions is rarely clear. The process of scrutinizing complex impact of multiple earn-out decisions can be guided only by a quantitative framework.

Let’s say a buyer will pay more if an acquired target achieves certain revenue in each of the first three years following the deal. Should the buyer agree on lower threshold in the first year in exchange for higher threshold in the second year, and if so, by how much?

Valuation models provide quantitative framework that will enable such multi-factor assessments. They can estimate probabilities of achieving various stand-alone revenue levels, incorporate dependencies between financial performance year-over-year, or measure how much of the total deal value (assumed liability for a buyer) is locked in an earn-out. The model can be reliable in predicting valuation impact of multiple earn-out conditions.