A financial forecast is a centerpiece of many valuations. It answers the principal question: “Why the business is valuable in the first place?” In strategic analysis, financial forecast links business strategy and value. In financial reporting, a financial forecast is a more refined, post-strategic-planning representation of a company’s expected financial performance.

A financial forecast is a centerpiece of many valuations. It answers the principal question: “Why the business is valuable in the first place?” In strategic analysis, financial forecast links business strategy and value. In financial reporting, a financial forecast is a more refined, post-strategic-planning representation of a company’s expected financial performance.

Explicit Financial Forecast or PFI

Valuations often require a long-term forecast, a.k.a. explicit financial forecast or projected financial information (PFI). It represents a bridge between a valuation date and that point in time when the company will settle with constant or desirable growth and profitability. The latter has to be consistent with industry norms.

The forecast will reflect strategic and tactical initiatives such as achieving economies of scale, releasing a new product, right-sizing expenses, or entering new markets all of which may take a few years to accomplish. The forecast would normally exclude business acquisitions or business initiatives in the very early or idea stage.

Top-down and Bottom-up Forecasting

A financial forecast can be developed with top-down and bottom-up approaches. The top-down approach starts with the total addressable market, estimating market share, price, and the ramp-up curve to the expected revenue. Expense forecast is more tactical, calculated as a revenue-supporting factor. The top-down approach is useful for fast-growing companies with readily accessible resources, including capital.

The bottom-up approach recognizes that growth will be constrained by the availability of resources. It focuses on the expected performance of incremental inputs such as sales force or production capacity. The bottom-up is suitable for established companies as well as bootstrapped startups.

How to Support PFI

As with most things in regulatory compliance, the financial forecast has to be supportable. A valuation specialist, as well as a reviewer, would have to scrutinize the underlying assumptions and resulting estimates. The testing would commonly be around comparing PFI to:

- actual results,

- historical trends,

- industry and economic trends, and

- specific drivers pertaining to the product, company, and broader factors.

Underlying assumptions would be more impactful when the company anticipates material changes in financial performance. Broader industry and economic trends would be relevant for larger, well-established business operations.

Common Weakness

The common forecasting pitfalls include:

- Building a product-focused rather than business-focused forecast, usually with exaggerated margins,

- Lacking overhead allocations,

- Lacking a sufficient number of years to achieve sustainable financial performance, i.e., profitability,

- Escalating or perpetually high, e.g., 40%, growth rate that reflects a desire more so than the reality,

- Extremely conservative or extremely optimistic forecasts, often prepared for unrelated purposes, such as cash management (too conservative) or M&A pitch (too optimistic).

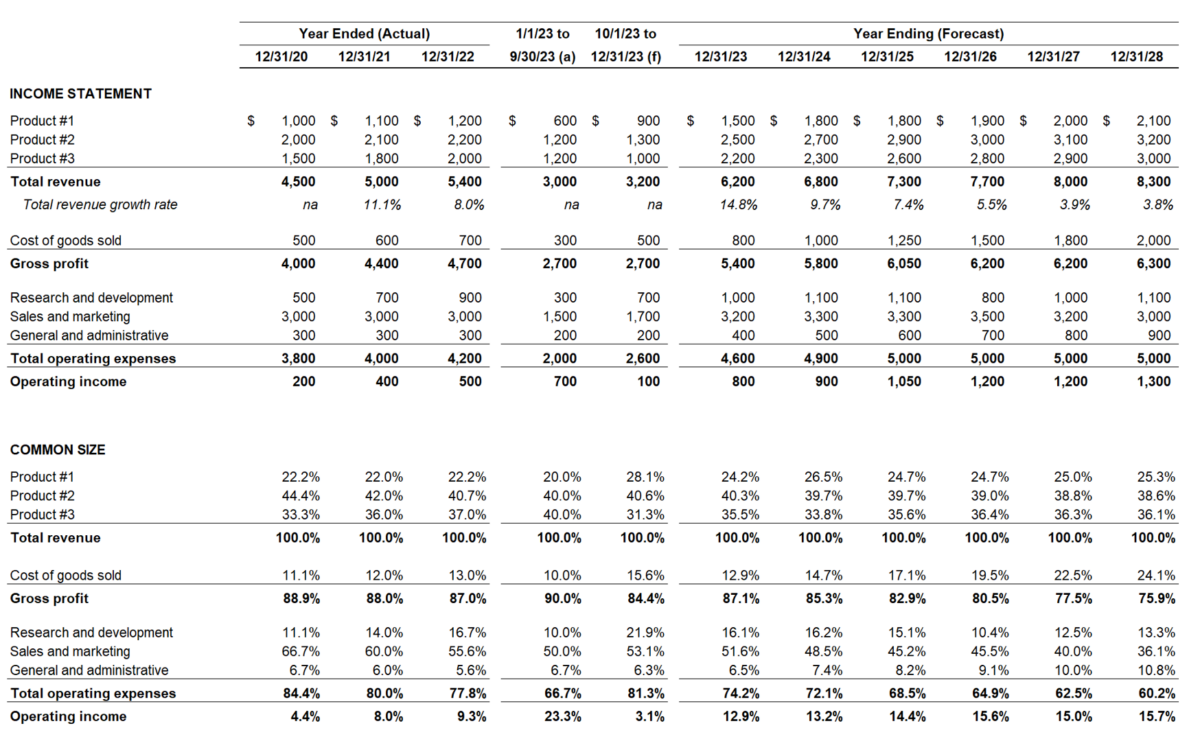

Below is a high-level example. A valuation specialist would always want to see as much information as possible. However, the minimal desirable level of detail is shown below.

Conclusion

Most business valuations, purchase price allocations, IP valuations, and impairment studies require a robust financial forecast. It is often not available. An existing forecast may not work and need to be revised due to some of the reasons outlined above. We recommend that the topic of financial forecasts be brought up as soon as possible in the course of any valuation project.